Top 5 Credit Cards For Dropshipping

Are you a dropshipping entrepreneur? Are you wondering if credit cards are the right way for you to pay for expenses?

It might seem like a little piece of plastic, but make no mistake: a credit card is a powerful and useful tool for dropshippers. If used properly, it can really make the difference in making your store more successful!

Of course, there are all kinds of cautionary tales about financial mismanagement and credit card debt, but as long as you’re responsible and stay on top of your monthly payments, then you’ll enjoy all the benefits of using credit cards.

In this post, we’ll talk about the dropshipping expenses that you can put on your credit cards. We’ll also go over what you should look for and the top credit cards for dropshipping available on the market today.

What Are The Benefits Of Using A Credit Card For Dropshipping?

If you want to really up your dropshipping game, then using a credit card can definitely help you! At the end of the day, it just makes good business sense.

There are quite a few benefits, including:

- Effective cash flow management so that you can better control your dropshipping store’s liquidity.

- Ability to space out the payments for various expenses and tools (we cover all the dropshipping costs you can pay for with credit cards below).

- Extensive rewards programs, cashback, and perks from the credit card processor.

- An easy and efficient way to increase your FICO score and build up your credit history.

- Eligibility for better interest rates and larger lines of credit in both your personal and professional lives.

As you can see, using a credit card can be a game-changer. It can help you take your dropshipping store to the next level while you enjoy all these benefits.

However, you do have to be very careful to stay on top of your payments so that you don’t get overwhelmed with the interest. It does take a certain amount of discipline and financial responsibility to make the credit cards work for you and not against you.

How Do I Use A Dropshipping Credit Card?

We’ve established the benefits, but now you might be asking yourself: How do I actually use a credit card for dropshipping?

It’s important to remember that even though dropshipping has fewer expenses than other retail models, like Amazon FBA or inventory-holding, there’s still plenty you’ll have to spend money on.

Additionally, you can’t start dropshipping with no money – there are always some startup costs.

Let’s take a moment to look at the types of dropshipping expenses that you can pay for with a credit card:

Supplier Cost

Finding the right dropshipping supplier is absolutely crucial to your store’s success. Remember, it’s your supplier that stores, packs, and ships your orders to the final consumer. In fact, when it comes to dropshipping, it’s best to think of the business relationship between retailer and supplier as a collaboration.

Of course, if you want to take advantage of a supplier’s services, you’ll have to pay them. This can either be a membership – usually an annual fee – or a per-order charge. Either way, most suppliers prefer credit cards or debit cards over other payment methods like check or PayPal. This is especially true if it’s a membership and they require a recurring charge.

In fact, some suppliers only accept credit cards or debit cards. However, the advantages of using a credit card over a debit card include all the rewards, cashback, and perks that come with a credit card. Plus, you can build your credit score, making you eligible for more competitive interest rates on any future loans or lines of credit.

Finally, using credit cards can help you with cash flow management – you won’t have to pay for everything right off the bat. Instead, you can space out your expenses. You just have to be responsible and timely with your payments to avoid compound interest that can pile up!

Product Orders To Your Supplier

If your supplier charges a membership fee, then you’ll still have to pay them for the actual orders that you need to ship to your customers.

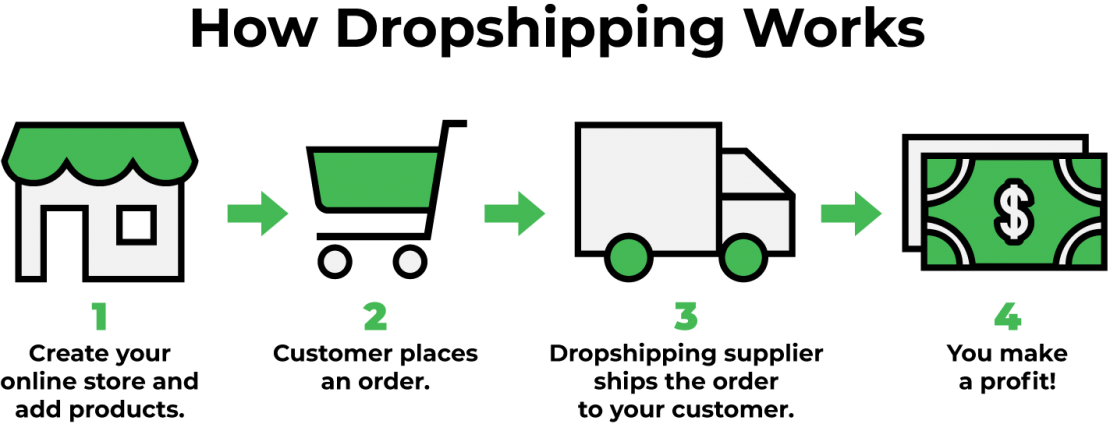

Let’s take a moment to quickly review the basic steps of dropshipping:

Something crucial happens in between Steps 2 and 3 in the graphic above: you have to place the order with your dropshipping supplier!

Make sure you don’t wait – as soon as you receive the order then you should immediately place the order with your supplier. This ensures that the customer doesn’t wait too long for their products. This is a common mistake that beginner dropshippers make and it can seriously damage your reputation – customers hate waiting too long.

However, there may be a delay between you receiving the payment from your customer via a payment gateway that you set up on your store and you placing the order with your supplier. In other words, the money you’ll be receiving from the customer may not reach you before you have to actually order the products from your supplier.

In this situation, using a credit card is best! This means that you temporarily front the order cost on your credit card until your supplier fulfills the order and the customer receives it. That way the customer doesn’t wait for their order and becomes dissatisfied with your store.

Advertising & Marketing

You know the old saying: sometimes you have to spend money to make money. This is especially true when it comes to your dropshipping store! The primary way you’re going to get customers into your store is via advertising and marketing.

This is where credit cards really come in handy for dropshipping. You can use them to pay for ad campaigns, especially with Google Ads and/or Facebook Ads. Again, this allows you to implement cash management strategies that won’t empty your account out before you have a chance to start making some conversions.

Plus, there are certain rewards credit cards that will give you extra points when you spend on ad buys, especially through Facebook Ads. You can also pay for email marketing tools like MailChimp with your dropshipping credit card.

To learn more about marketing and advertising for your dropshipping store, make sure you check out these related blog posts:

- Facebook Marketing For Dropshipping: Tips To Succeed

- How To Create Instagram Ads For Dropshipping That Convert

- Powerful Content Marketing Strategies For Dropshipping

- Top Email Marketing Strategies For Dropshipping

- Your Complete Marketing Guide For Dropshipping

Your Dropshipping Website

To start making sales, you’ll have to invest the time and money into building a dropshipping website. This includes a few startup costs like:

- Choosing a web host

- Installing a shopping cart

- Getting an SSL certificate

- Signing up for a credit card processor

- Purchasing a website template

Each of these is critical to having a trustworthy online store, so don’t skip any of these steps!

These expenses can be put on a dropshipping credit card, allowing you to quickly build up rewards points and your credit score.

Ecommerce Platform Membership

If you don’t want to build your own website but still want a slick-looking, highly functional, and well-designed store quickly and inexpensively, then using an Ecommerce platform is your best bet! The two most popular are Shopify and WooCommerce, both of which require a monthly payment to keep the store up and running.

To start dropshipping on Shopify, you have a choice of three plans: Basic for $29/month, Shopify for $79/month, and Advanced for $299/month. While it might seem like a large expense, the convenience and functionality that you get with using a platform like Shopify can really supercharge the profitability of your store.

Again, it’s best to put this expense on a dropshipping credit card. You can implement more effective cash flow management and rack up tons of rewards points because it’s a regular charge that you’ll see, month after month. You’ll also be able to build your credit up quickly!

Make sure you also check out our related blog posts Top 10 Shopify Dropshipping Tips You Need to Know and How To Find A Shopify Dropshipping Supplier.

Shopify Apps

If you do decide to use Shopify, then you can invest in apps. These are tools that help make your store more profitable, automated, and functional.

All the best Shopify apps require either a one-time startup fee or a monthly membership, so you can also put this expense on a dropshipping credit card. This is preferable to using a debit card since you might end up with liquidity problems if you spend all your available cash on additional tools like apps.

The wide variety of these apps is truly amazing – they seem to have at least one tool for every possible function in your dropshipping store.

To learn more about Shopify apps and how to use them, make sure you check out these related blog posts:

- Best Shopify Dropshipping Apps in 2021

- Top Shopify Design Apps To Build Your Store

- Top 6 Shopify Upsell And Cross-Sell Apps

- Best Shopify Review Apps to Build Your Store

- Top Trust Badges for Shopify To Convert Online Shoppers

GreenDropShip is a premium, gourmet, and specialty dropshipping supplier with thousands of natural and organic products as well as a Shopify dropshipping app that makes it easier than ever to add products to your store and build a profitable online business.

We require credit card payment for our annual membership as well as for the monthly cost of the app – however, you don’t need to choose our app to still dropship with us on Shopify. It certainly makes it easier, but we still offer product feeds if you decide to do it the old-fashioned way!

Ready to start selling online?

What Should I Look For In A Dropshipping Credit Card?

If you’re looking for a dropshipping credit card, you have a world of options! There are hundreds of choices from dozens of banks or creditors, so how do you know which one’s the right one for you?

In general, there are three basic types of credit cards:

- Secured credit cards that help you build or improve your credit (see the section below).

- Credit cards that save you money on interest.

- Rewards credit cards that give you points, cashback, or perks.

When choosing your credit card, there are a few things you should look out for:

Annual Percentage Rate (APR)

This is one of the most important criteria for choosing a credit card. It’s the cost of borrowing on the card if you don’t pay off the entire balance for a month.

You might think that this is effectively the same thing as an interest rate, but that’s not actually the case. The difference between APR and the interest rate is that the APR includes interest plus other loan or credit card fees. Remember, there’s more to a loan than the interest rate.

The APR factors in all these additional costs to show you what borrowing will cost you over a year. This is why the APR is usually higher than the interest rate.

When choosing a dropshipping credit card, you want to choose the lowest APR – this means you’re getting a better rate for borrowing money on the card. However, APR is linked with your FICO credit score: the higher your score, the lower your APR. This should give you a strong incentive to build up your credit!

However, the APR may not be important for everyone. For instance, if you plan on paying the balance on your credit card every month rather than spacing the payments out, then you don’t have to worry about the APR since you’ll never actually be charged that interest. In this situation, it means you’ll be using the credit card more for the rewards, cashback, or perks rather than as a cash management method.

Introductory Interest Rates

Credit card companies are trying to get your business, especially if you have great or even decent credit. They’ll use all kinds of promotional techniques to entice you, including introductory interest rates. Also known as teaser rates, this is an interest rate charged to a customer when they first sign up for a credit card.

This introductory rate can be as low as 0%! However, it is not permanent and after it expires a normal or higher than normal rate will apply. In most cases, these are usually for the first 6 to 18 months of signing up for a credit card.

The higher your FICO score, the more credit card companies will try to get you to sign up. For instance, having a score of 700 or above means that you’ll probably get lots of offers with excellent introductory rates.

It’s important to remember that these are temporary! Do not budget your credit card use based on the teaser rate – you should always structure your credit card use based on the permanent interest rate.

Minimum Payment Amount

Additionally, if you decide not to pay the full balance of what you owe each month, then you’ll still be required to pay a minimum amount each month to avoid any late fees. This is set by the creditor for the credit card in question, so you should look at the terms and conditions to determine this minimum amount.

In most cases, you’ll owe either a fixed amount — usually about $25 — or a percentage of the balance, whichever’s greater. Some cards require you to pay between 1% and 3% of the balance monthly, plus any fees and accrued interest.

Making these minimum amount payments means you’ll avoid any late fees, but you won’t make any real progress on paying down your balance. But you’ll still have to pay interest on the unpaid balance. If you only make the minimum payments, the compounding interest will add up and it can become difficult to pay off your credit card.

Credit Limit

The credit limit is the maximum amount of money you can charge to a credit card before you face a penalty. Also known as a line of credit, credit line, or spending limit, the higher your credit limit, the more overall credit you have to rely on.

According to data from Experian, Americans have a total credit limit of $22,751 across all their credit cards. However, it’s important to remember the key phrase “across all their credit cards” – you’ll have to determine what the credit limit is for each credit card that you obtain.

The higher your FICO score and the longer your credit history, the higher your credit limit will be. Essentially, creditors use this data to determine how trustworthy you are and give you a greater limit that you can spend without any penalty.

Annual Fees

Some credit cards have annual fees that are necessary for you to pay in order to obtain the card. This can vary from credit card to credit card, with some even having a $0 annual fee.

According to 2020 data from ValuePenguin, the average annual fee for credit cards that actually have annual fees is $147.

However, in most cases, the more “premium” cards will have more substantial fees while “beginner” credit cards – including secured credit cards that we discuss below – might not have an annual fee at all. It’ll be up to you to decide if the annual fee is worth the rewards, cashback, or perks that you might get.

Fees & Charges

When choosing a dropshipping credit card, make sure you read the credit agreement to learn about any additional fees or charges that might be included in the card. These can range from reasonable to exorbitant, so it’ll make all the difference!

Fees and charges you should look out for include:

- Late fees

- Over limit fees

- Foreign transaction fees

- Balance transfer charges

- Cash advances

- Returned payment fees

- Card replacement fees

That’s a lot to consider! The good news is that the creditor must make all of this crystal clear in your credit agreement – it’s illegal for them to hide any of these fees from you while you’re signing up for the credit card.

That’s not to say that they make it easy to find this information. When choosing a dropshipping credit card, make sure you read all the fine print on anything you sign! If you stay vigilant, then you’ll avoid getting saddled with burdensome fees and charges.

Rewards, Cashback & Perks

Last but certainly not least, you definitely need to consider the rewards, cashback, or perks of any dropshipping credit card. In fact, for some online retailers, this is the single most important thing to consider.

This is especially true if you’re planning on paying off the balance every month to avoid any interest. By doing so, you’ll accumulate points that you can then redeem for rewards or even cold, hard cash.

However, it’s important to note that rewards credit cards usually have higher APRs, so it’s probably best that you always pay your balance off every month.

Common reward programs include:

- Airline miles. This is usually for a single airline, like Southwest or Alaska Airlines. Certain purchases will give you double or triple points that you then use for airline tickets.

- Travel expenses. You might be able to also earn points that can then be used to pay for certain travel expenses, like hotels, car rentals, or even cruises.

- Discounts. Some credit cards will offer you discounts or cashback for certain retail outlets, like Amazon or BestBuy.

- Groceries or gas. You may also be able to accrue points that you can then use for certain products like groceries or gas.

You’ll need to pay attention to how you earn these reward points. For instance, some credit cards will give you double or triple points if you spend on apps like Uber, DoorDash, or Lyft.

Certain credit card reward programs will give you extra points for advertising costs – as you might imagine, this is especially useful for dropshipping. For instance, there are credit cards that’ll give you x3 rewards points for every dollar you spend on Facebook Ads.

Finally, always make sure that you’ve read the Terms & Conditions and Credit Agreement very carefully since many reward credit cards can be really complicated. If you don’t want to deal with terms like limited award seat availability, spending caps, rotating bonus rewards, and loyalty tiers, then you should consider a card with flat-rate cash-back rewards.

Top 5 Credit Cards For Dropshipping

Let’s take a look at the best credit cards for dropshipping:

American Express (Amex) Business Gold Card

The Amex Business Gold card is perfect if you’re making a lot of purchases for your dropshipping store. Plus, it has automatically-adjusted bonus categories so you don’t have to worry about your points strategy.

You can earn 4x Membership Rewards points for each $1 spent monthly on your top 2 categories:

- Airfare

- Advertising in select media

- Computer hardware, software, and cloud solutions

- Gas

- Restaurants

- Shipping

In other words, you can mix and match your rewards categories. However, you don’t have to select a category. Instead, Amex will automatically calculate which categories you spent the most on so that you can earn maximum points.

- Annual Fee: $295

- Regular APR: Between 14.24% and 22.24%, based on FICO score

- Credit Score Required: 670 to 850 (Good to Excellent)

- Membership Rewards Amount: Between 100,000 and 200,000 points

American Express (Amex) Business Platinum

The Amex Business Platinum Card is perfect for small business owners who charge thousands of dollars in monthly business expenses. As we mentioned above, dropshipping is by far the most inexpensive retail model, but there are still expenses you’ll need to handle.

Let’s take a look at some key benefits and information:

- 100,000 Membership Rewards points after you spend $15k on eligible purchases within 3 months.

- 5X Membership Rewards points for flights and prepaid hotels booked through Amex.

- 50% bonus points for purchases above $5k.

It’s also perfect for entrepreneurs who are regular travelers and can take advantage of all the premium benefits. Ultimately, it’s one of the best dropshipping credit cards available.

- Annual Fee: $595

- Credit Score Required: 670 to 850 (Good to Excellent)

- Regular APR: Between 14.24% and 22.24%, based on FICO score

CHASE Ink Business Preferred

This is one of the most widely-used business credit cards that Chase has to offer. It’s especially popular with small to medium-sized business owners, including dropshippers looking to expand their store and operations.

You can also earn 3x Chase Ultimate Rewards points on your first $150k spent on the following business categories:

- Travel and airfare

- Shipping purchases

- Internet, cable, and phone services

- Advertising buys with Google and/or Facebook

This card is especially beneficial if you maximize the points by using it for your Facebook and Google Ad buys. That alone will more than justify getting the card – you could easily rack up huge rewards.

In theory, you could earn 450,000 Chase points every year, which would be worth a whopping $9,000!

- Annual Fee: $95

- Credit Score Required: 670 to 850 (Good to Excellent)

- Regular APR: 15.99% to 20.99% (V)

Bank Of America Business Advantage Travel Rewards World Mastercard

This is a simple and versatile option that’s perfect for a dropshipper looking for a travel rewards card with no annual fee.

- Introductory rate of 0% APR for first 9 billing cycles.

- Earn 1.5 unlimited points for every $1 everywhere.

- Earn 3 points for every $1 on travel purchases booked through Bank of America Travel Center.

- If you spent $3,000 within 90 days of opening your account, you can earn up to 30,000 bonus points.

- Annual Fee: $0

- Regular APR: 12.24% to 22.24% (V) depending on FICO

- Foreign Transaction Fee: None

- Credit Score Required: 720 to 850 (Excellent)

Discover It Business Credit Card

This is another credit card that’s perfect for dropshipping entrepreneurs. It’s Discover’s standard business card and is actually the regular version of the “secured” credit card we discuss below.

Unlike other cashback or rewards credit cards, this one is fairly streamlined and simple. You don’t have to keep track of tons of different categories and can simply build up points with regular purchases.

- Earns 1.5% cashback on every purchase

- No bonus categories for you to keep track of

- Discover matches your cashback after your first account year

- Rewards never expire

- Discover offers Cashback Match – allowing you to double your cashback points

- Add up to 50 free employee cards

- Annual Fee: $0

- Introductory APR: 0% for first 12 months

- Regular APR: 14.49% to 22.49%

- Credit Score Required: 690 to 850 (Good to Excellent)

Can I Get A Credit Card With Bad Or No Credit?

First of all, it’s important to understand what “credit” means in this context. It refers to the FICO score that’s used by all major banks and creditors. It’s a comparative estimate of a person’s creditworthiness – it basically makes an educated guess on how likely you are to honor your debts to your creditors.

It’s based on reports from the three credit agencies: Equifax, Experian, and TransUnion. It ranges from 300 to 850, with each level breaking down as follows:

- Exceptional. Above 800.

- Very Good. 740 to 799.

- Good. 670 to 739.

- Fair. 580 to 669.

- Poor. Below 579.

Additionally, you need to understand what criteria the credit bureaus use to actually calculate your FICO score:

- Payment History: 35%.

- Amounts Owed: 30%.

- Length of Credit History: 15%.

- New Credit: 10%.

- Credit Mix: 10%.

As you can see, your Payment History is by far the most important factor in building and/or improving your credit score. What does this mean? Pay your bills early or on time, every single month – no exceptions!

The higher your FICO score, the more likely you are to get approved (or even pre-approved) for a credit card. Plus, you’ll also get better deals on fees and lower APR rates as the credit card companies effectively compete with one another to get your business.

Now it’s important to understand the difference between having “no credit” and “bad credit”. While it’s effectively impossible to truly have “no credit” in this day and age unless you live in the woods or something, it is possible that you haven’t had a chance to build up a significant credit history to bolster your FICO score.

On the other hand, having “bad credit” means that you’ve misused your credit cards or loans in the past, making it less likely that you’ll get approved for a credit card. Either way, you’re going to have to build up your FICO score, brick by brick.

Thankfully, there are some options that you can use to effectively start your positive credit history or reverse your poor credit.

Get a secured credit card

This absolutely your best option to build up or rehabilitate your credit fast!

A secured credit card just means that you have to pay money with the credit card issuer to open an account. This payment is also known as a security deposit, similar to a security deposit that you give to a landlord when renting a house or apartment.

This security deposit is held as a form of collateral by the credit card issuer as long as the account is open. Usually, the amount of the deposit is the amount of credit that’s granted. So, if you pay a deposit of $200, then you have a $200 line of credit!

This is a fantastic option for anyone who’s establishing, building, or rebuilding their credit. In fact, secured credit cards were pretty much designed with this specific purpose in mind – they’re used by credit card issuers to extend a line of credit to a “higher-risk” customer.

If you’re looking for credit cards for dropshipping and you don’t have the necessary credit history, then you can use a secured credit card to boost your FICO score quickly, efficiently, and safely. Just charge as much as you can to the card – like paying your supplier or making ad buys – and then promptly pay it off.

Secured credit cards tend to have higher APRs and little to no rewards, but it’s important to remember that they’re basically a stepping stone to more competitive credit cards with better terms and perks.

Here are a few of the best options for secured credit cards:

BankAmericard® Secured Credit Card

Issued by Bank of America, your maximum credit limit is determined by the security deposit and your income. If you pay a deposit that’s greater than the calculated maximum amount based on your ability to pay, then you’ll get a check for the difference.

The issuer will regularly review your account history. If you pay promptly and on time, then your FICO score improves until you may actually get your deposit returned. Amazingly, you don’t need any credit history or a Poor credit rating to be “approved”.

- Annual Fee: $0

- Regular APR: 22.99%

- Penalty APR: None.

Capital One QuicksilverOne Cash Rewards Credit Card

This is one of the best rewards cards for people with little to no credit. You get 1.5% cashback on all purchases – this is better than most cash rewards cards!

However, QuicksilverOne Cash Rewards does have a $39 annual fee. But if you charge at least $2,600 per year to the card, you will earn enough in rewards to balance out the cost of the fee. You just need to make sure that you pay your balance by the due date every month and avoid any interest.

- Annual Fee: $39.

- Rewards Rate: 1.5% Cash Back

- Regular APR: 26.99% (V)

Discover it® Secured Credit Card

This is another great secured credit card for people with little to no credit. However, this card is unique: it has both a $0 annual fee and rewards. You earn 2% cashback on up to $1,000 spent at gas stations and restaurants every quarter, as well as unlimited 1% cashback on all other purchases.

Plus, Discover also doubles users’ first-year rewards earnings as an anniversary present. There are also automatic reviews starting at 8 months to see if you can be transitioned to an unsecured line of credit, so just make sure you always pay on time!

- Minimum Deposit: $200.00

- Annual Fee: $0

- Rewards Rate: 1 to 2% Cash Back

- Regular APR: 22.99% (V)

OpenSky® Secured Visa® Credit Card

This is quite possibly the easiest secured credit card to get with no credit. In fact, there’s actually no credit check when you apply, so approval is nearly guaranteed for anyone who’s at least 18 years old with enough income to afford monthly bill payments.

It has a $35 annual fee and requires a refundable security deposit of at least $200, the amount of which will be the account’s spending limit. Plus, 99% of OpenSky customers who started without a credit score earned a credit score record with the credit bureaus in as little as 6 months.

- Minimum Deposit: $200.00

- Annual Fee: $35.00

- Regular APR: 17.39% (V)

- Penalty APR: None

First Progress Platinum Prestige Mastercard® Secured Credit Card

This is another fantastic secured credit card that can work well for any dropshipper looking to build their credit quickly and efficiently – it includes monthly reporting to all three credit bureaus. If you’re pressed for time, you can receive your card more quickly with the new Expedited Processing Option.

Plus, you don’t need to have any credit history or minimum credit score for approval – anyone can start with this card! In fact, you don’t even need to do a credit inquiry at all. You secure your credit line with a fully refundable deposit of between $200 and $2,000 that you submit with your application.

- Minimum Deposit: $200.00

- Maximum Deposit: $2,000.00

- Annual Fee: $49.00

- Ongoing APR: 9.99% (V)

- Foreign Transaction Fee: 3%

Apply for a retail or student credit card

Secured credit cards are still your best bet, but if for some reason that’s not a viable option, then you could always consider a retail or student credit card.

Retail credit cards – also known as store credit cards – are offered by a specific retailer. The most common types are from department stores, like a Macy’s card or a Nordstrom card.

They often have low barriers to approval, allowing retailers to encourage consumer loyalty, so it may be possible to qualify for a retail credit card with no credit. But it’s not a sure thing. If you are approved, you’re likely to be subject to an above-average APR and a low credit limit.

The major limitation is that you can only build credit by spending money at the retailer in question – you won’t be able to use these retail credit cards to pay for expenses for your dropshipping store.

On the other hand, student credit cards are offered to college students who may be new to credit. They may have student-friendly terms, such as rewards and no annual fee. However, to qualify for these you generally have to be a college student and will have to provide proof.

Become an authorized user

If you’re looking for a dropshipping credit card but you don’t have the credit score or history to get your own, you can always become an authorized user. It can be a simple and effective tactic if you’re still working to establish your own credit score.

While it’s certainly not a substitute for building up your own credit history, it may be a good way to give your credit a nice boost as you’re getting started. Everyone has to start somewhere!

But there is a downside: Your credit can also be hurt if the primary account holder doesn’t stay on top of their payments. This means that there has to be a certain amount of mutual trust between you and the primary account holder.

As a result, most dropshippers looking to build credit will become authorized users on a family member’s card, like your parents or even spouse.

Start Dropshipping With GreenDropShip

We’ve discussed the importance of finding the right credit card for dropshipping, now you’ll need to choose the right dropshipping supplier.

You need to make sure that they meet the following requirements:

- Knowledgeable sales and support representatives.

- High-quality products that meet consumer demand.

- Tools to help you track your inventory and sales.

- Be reliable, timely, and efficient in their shipping and packaging.

Luckily for you, GreenDropShip fits the bill perfectly! We’re a US-based wholesaler and dropshipping supplier with thousands of natural and organic products. Most of these items are made in the USA and come from in-demand brands that consumers know and love.

We have a huge selection of specialty and gourmet products in our inventory, including:

- Beverages like coffee, tea, kombucha, yerba mate, natural soda, and juices

- Organic sugar and natural sweeteners

- Dairy and plant-based milk

- Baking ingredients, including different types of flour

- Sauces, marinades, and dressings

- Spices and ingredients

- Vegan, vegetarian, and plant-based goods

- Vitamins and supplements

- Skincare, haircare, and beauty products

- Baby products

- Home products like detergents, soaps, and cleaning supplies

- Pet food, treats, and supplements

- Essential oils and aromatherapy

Become a dropshipping member and we’ll store, pack, and ship your orders to your customers. We have multiple warehouses throughout the country, so our shipping times are always short and your customers won’t wait long.

We also function as a conventional wholesaler, so you can purchase products in bulk from us and we’ll ship them to you. This means that you’ll handle storing, packing, and shipping them to your customers.

You can pay for your GreenDropShip membership with any major credit card, including VISA, Mastercard, Amex, or Discover. We currently do not accept any other forms of payment.

We also offer a Shopify dropshipping app that makes it easier than ever to add products to your store. If you’d rather not use the app, we also offer product feeds so you can use our dropshipping platform to sell products on Shopify, WooCommerce, or Amazon/eBay.